Retailers are seeing increased demand and very few drawbacks to selling lab-grown diamonds. Is this the dawn of a détente between supporters of mined versus man-made gems, or simply a temporary cease-fire?

The jewelry industry’s long-standing fear of lab-grown diamonds appears to be rapidly disappearing. Instead of complaining about the potential damage nontransparency could wreak and the adverse effect man-made stones could have on the global diamond market, retailers are chanting about the emerging business opportunities.

Consumers, too, have shown a willingness to embrace lab-grown diamonds and are gladly eschewing stones mined from the earth in favor of manufactured gems—particularly if they come at a more affordable price. According to anecdotal evidence reported by JCK, the turnaround seems to have begun roughly two years ago.

Morgan Stanley estimates that by 2020, lab-grown diamonds could account for 15% of sales of gem-quality melee diamonds (defined as less than half a carat in rough form) and 7.5% of sales of larger diamonds. Paul Zimnisky Diamond Analytics projects the lab-created diamond jewelry market will grow to $15 billion by 2035.

If you need further convincing, consider the degree to which the walls separating the mined-diamond community and lab-grown have fallen—to wit, De Beers’ foray into the lab-grown market with its wholly owned subsidiary Lightbox, which debuted at JCK Las Vegas in May 2018. Of course, the company had a huge leg up in the category: Element Six, De Beers’ synthetic-producing subsidiary, has been turning out lab-grown diamond discs for the manufacturing sector for the past 30 years, and has mastered the process of growing gemstones.

“We did a lot of analysis before we launched this,” says Steve Coe, CEO of Lightbox. “The company took the view, like any new technology, once it’s been developed, you can’t put it back in its box.”

Lightbox has since hosted retail pop-ups in New York City, Miami, and Los Angeles and is considering a permanent retail venture. In mid-October, the brand announced a brick-and-mortar wholesale trial with select Bloomingdale’s and Reeds Jewelers locations. While news like this clearly suggests there’s momentum behind the lab-grown business, statistics are not yet available to quantify how many stores are exploring the category.

“No one has a supportable handle on the number of retailers currently carrying lab-grown diamonds,” says Chris Casey, president of the New York City–based Lab-Grown Diamond Council. “We will be looking to provide this information in the first quarter of 2020 but anything prior to that is just a guess.”

JCK wanted to know more: How are lab-grown diamonds affecting jewelers around the country, how are they influencing mined-diamond business, and how are consumers responding?

Devon Bond, co-owner of Garrick Jewelers in Hanover, Pa., has been selling lab-grown diamonds for about three years. He began purchasing Diamond Foundry lab-grown gems—Leonardo DiCaprio is an investor—in 2016, around the time the brand began laser-inscribing its product.

“We felt it was better to be the first jewelry store in our area to offer and explain lab-grown diamonds rather than keep our heads in the sand and ignore them,” Bond says.

The store initially began carrying 0.5 ct. to 1.25 ct. stones; they saw about one or two sales of lab-grown diamonds per month. Today, the store sells two to four lab-grown diamonds per month outside of the holiday season. “This year, we are expanding into a complete bridal and fashion line in 14 karat gold with lab-grown diamonds,” Bond says.

Surprisingly, sales of lab-grown diamonds at Garrick have not affected sales of the store’s mined diamonds. “Most customers come in wanting mined diamonds,” Bond says. “We offer [lab-grown] as an alternative and allow our customer to decide. Sometimes the customer has a budget that will not allow them to purchase a mined diamond of the size and quality they want, and they will gladly explore lab-grown.”

Bond says his biggest fear is that lab-grown diamonds will be misrepresented. That would be commensurate with financial suicide. “I think the more we know and accept them, the safer you are.”

Committed to the Cause

Amanda Brotman, owner of Amanda Pearl in New York City, is one of the more recent converts, having made the switch to exclusively selling lab-grown diamonds in her designs and in her store earlier this year. As a retailer and designer, she believes in the product’s ethical message. “There’s a huge market for it,” she says. “From an environmental and social standpoint, it just makes sense. Doing something positive is a huge selling point. And I feel good we’re not supporting terrorism or slave labor.… We’re all in.”

For the holidays, Brotman says she will treat her lab-grown diamonds much as she sold mined diamonds in the past. She will create a “normal” marketing push, including promoting the lab-grown diamonds as a giftable item.

If there’s been any pushback from consumers regarding her switch to lab-grown, Brotman is not aware of it. “If anything, people get excited about them,” she says. “Our customer is pretty well-informed and someone who cares about these diamonds being traceable. They know for certain that they’re not supporting anything bad.”

On Demand

Even established jewelers, some of whom have been in operation for dozens of years, are embracing lab-grown diamonds. Roz Gordon, co-owner of Gordon Jewelers in Boonville, Mo., has carried New York City–based ALTR Created Diamonds since 2017. “Well, we have to keep up with technology,” says the retailer, who made the decision after watching the evolution of lab-grown colored stones over the years. “We have mined diamonds alongside lab-grown, and we disclose it up front.”

Gordon says it’s wrong to believe that lab-grown diamonds are for millennials or exclusively for a younger customer. “I sold a lab-grown diamond to a gal in her upper 50s,” she says, adding that the store has seen more growth with lab-grown diamonds than with lab-grown colored stones. “We sell to all ages. It comes down to what their beliefs are. Do they want diamonds grown in the earth or grown in the lab?”

Although her store offers jewelry ranging from $100 to $10,000, Gordon will not be positioning the lab-grown diamonds as stocking stuffers for the holidays. Her rural farming community recently experienced a rash of floods, and she fears she would offend people by offering them on the cheap. Still, Gordon is optimistic that the lab-grown stones will do well this holiday and into 2020.

A number of retailers are entering the lab-grown arena in response to customer demand. Designer John Atencio, owner of seven jewelry stores in Colorado, says his company has always been dedicated to mined diamonds but heeded the call of consumers about two years ago. “As our customers were asking for more, and in some cases were going to buy solely lab-grown diamonds, we made the decision to start sourcing and selling those types of stones,” Atencio says.

Within the last few years, Atencio has seen the market change drastically; his stores now carry several lab-grown brands, including Diamond Foundry. The retailer currently offers lab-created diamonds for bridal and diamond rings but made the decision not to introduce the stones into his own eponymous jewelry collection. “Customers seem split and very well-educated in the choices they have,” Atencio says. “Both types of stones—mined and lab-grown—are very relevant, and we are happy to serve and sell each type with full disclosure, confidence, and integrity.”

Like other retailers, Atencio believes strongly in full transparency, both between lab-grown manufacturers and retailers and between retailers and their customers. If the rest of the industry can be counted on to do the same, he’s convinced there is very little getting in the way of this burgeoning market.

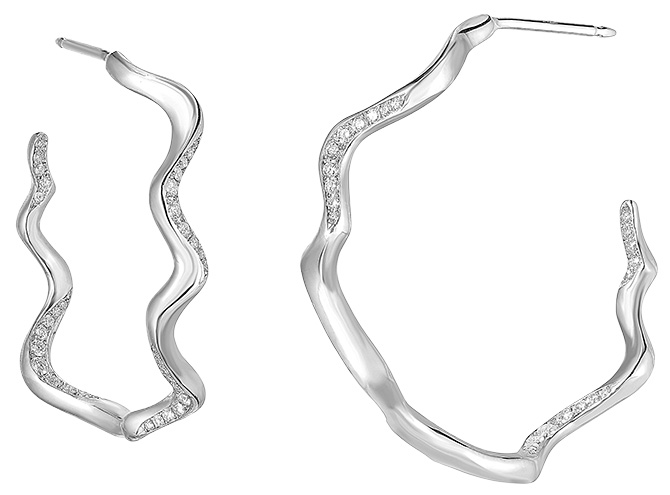

Top: Stacking rings with 0.375 ct. lab-grown pink, blue, and white diamonds in 10k yellow gold; $600 each; Lightbox; 866-657-7622; lightboxjewelry.com

Claims of Responsibility

Will “sustainably grown diamonds” be the industry’s next big thing?

After the Federal Trade Commission warned lab-grown companies not to call themselves eco-friendly or sustainable, many moved away from those claims. But the newly formed Lab-Grown Diamond Council has enlisted SCS Global Services, the certification company that has worked for the Responsible Jewellery Council and Brilliant Earth, to develop a standard that will allow certain lab-grown diamonds to be called “sustainably grown.”

The standard will have three pillars: environmental impact, social responsibility, and community benefit, says Stanley Mathuram, vice president of corporate sales at SCS.

The environmental standard will require companies to begin making their operations carbon neutral, and to account for the ecological impact of any mined materials used in the diamond growing process. The social responsibility standard will audit the company’s factories and cutters and measure their wages, working conditions, and whether they have or allow collective bargaining. The third pillar ensures that a company is incorporating some form of community benefit into its business model. “Sustainability means nothing if a company just does what’s needed,” Mathuram says. “It is more than just carbon.”

Furthermore, every “sustainably grown diamond” would have to be tracked through the supply chain, from the factory to the retailer. This won’t be easy, Mathuram admits, and he has gotten some pushback from growers, who up until now have been making these claims without any problems. But he feels it’s necessary in the new environment.

“None of the current [eco-friendly] claims are substantiated,” Mathuram says. “The FTC is being listened to by all the growers. It’s not the Wild West and the consumer is getting smarter, and they understand that environmental issues are a big deal, social issues are a big deal, climate issues are a big, big deal. It goes back to: We can’t just keep saying what we want anymore.” —Rob Bates