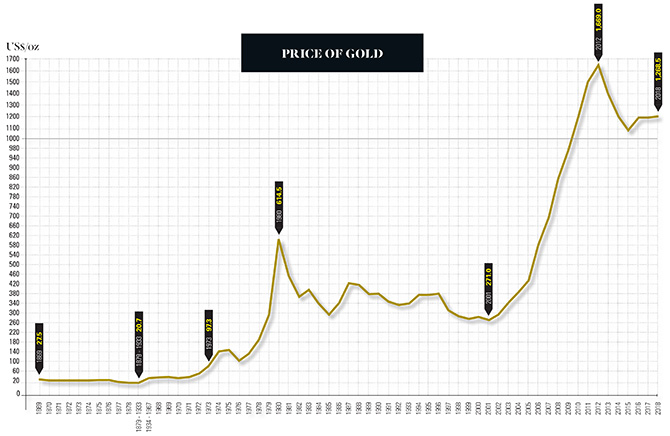

In JCK’s first 100 years, the metal’s price didn’t move much. But over the past 50, it’s been on something of a roller-coaster ride.

For most of the 20th century, the price of gold bullion was set at $35 per ounce. In 1968, the London Gold Pool created a two-tiered system that let gold respond to supply and demand, and the metal has been on a wild ride ever since. In January 1980, geopolitical angst and rising oil prices pushed the price to a then-record $873 an ounce, more than double what it had been just two months prior. That now-legendary spike didn’t last long. By the end of 1981, the price had settled back at $400. In 2001, gold began a remarkable 12-year bull run, crossing the $1,000 threshold in 2009, and introducing jewelers to a whole new profit center—trade-ins. “When it reached $1,300,” one retailer told JCK in 2010, “it was like a bus pulled up.” In August 2011, gold hit $1,910, which turned out to be its peak. Two years later, the metal posted its first annual loss in 13 years. Five years later, it was trading below $1,100. But gold is nothing if not resilient. At press time, the king of metals had staged yet another comeback, soaring toward $1,550, and perhaps setting the stage for another gold rush.

Top: Willow Chandelier earrings in 24k gold; $2,550; gurhan.com

(Data courtesy of Roy Jastram, Datastream, World Gold Council)