Analytics firm GemFind Digital Solutions recently released the latest edition of its semiannual “Diamond Click Trends” research report, which analyzes hundreds of online searches by diamond consumers.

Here’s what the study reveals about what consumers are looking for—and how they prioritize diamond characteristics—when searching for stones online.

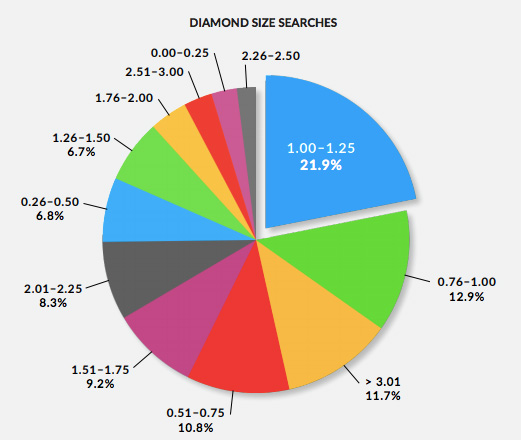

The most popular diamond carat weight is 1–1.25 carat.

Diamonds 0.75–1 ct. make up the majority of the other consumer searches (see chart below). “This mirrors the engagement ring market and the economics and income level of millennials and others planning an engagement,” reads the report. “The 1-1.25 carat sizes remain a key perception as the most desired carat weight for an engagement ring.”

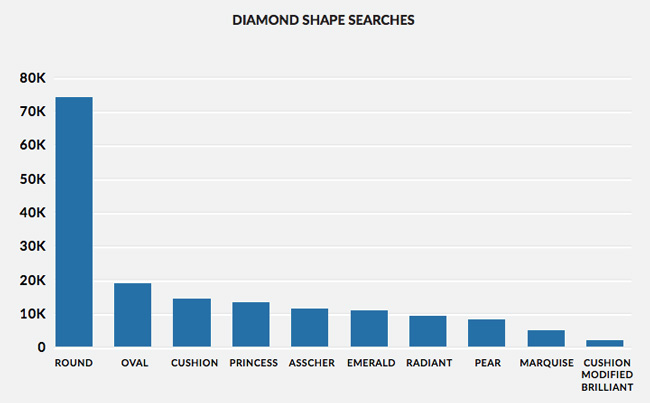

Round remains the most popular shape.

By a long shot! (see graph above). But ovals have risen in popularity and have narrowly overtaken both cushions and princesses in online searches. The square cuts (cushion, princess, Asscher) dominate roughly one-fifth of the shape searches by consumers, according to the report.

The most popular diamond colors are G, followed by H and F

“The difference in DEF colors compared to G color cannot be readily seen by a consumer and is a function of rarity more than beauty,” according to the report. Though the predominance of the G–H color range does show “consumers understand diamond color and pricing for those colors in comparison with the DEF range.”

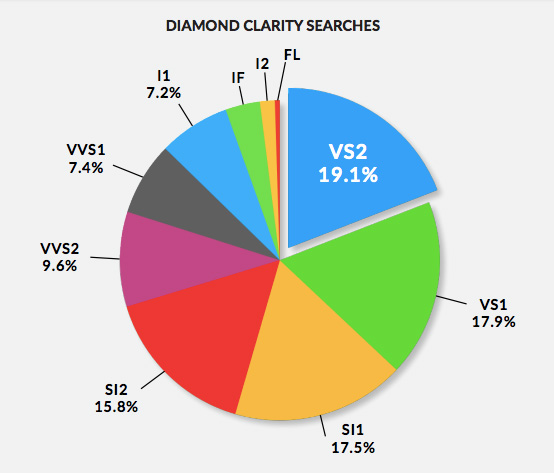

Shoppers’ prioritize clarity, but only partially understand it.

“By far, the largest search segment in diamond clarity is VS1 and VS2,” reads the report (see chart below). “Taken together this represents almost 40% of all diamond searches. The higher clarity demand reflects on the education of consumers and their product knowledge in general. Typically, a consumer wants the best quality without fully understanding the clarity levels. Few consumers understand that an SI1 or even an SI2 can be just as beautiful and brilliant as a VS stone. On the other hand, the very highest clarity levels of IF, flawless VVS1 and VVS2 are a very small share of the searches. Consumers show a preference for inclusion-free stones. Even though SI stones are eye clean, the consumer lack of preference in these areas illustrates key perceptions in the diamond market.”

Consumer understanding of cut grade is also limited.

Most consumers don’t search for diamond cut grades, says the study. But of those who search for cut, “the excellent cut grade predominates the area.” And excellent cut grades are expensive and rare, and the number of stones from diamond searches are limited. “Of the Four Cs, the consumer understands cut grade the least.”

Knowledge of GIA and diamond grading is even more limited.

“Those who do search for diamonds by the certificate show a complete preference and predominance of GIA,” according to he study. “The other labs are not known to the consumer. Most consumers have some understanding, given the diamond certificate search, of the added value a GIA certificate gives a stone. The GIA certificate premium can range from 5% to 20% depending on the stone.”

Loose diamond shoppers focus searches in February and March.

Therefore, the study reasons, “men are searching for diamonds and planning their engagement in the early spring.”

Top: Brilliant Earth Luxe Viviana ring (photo courtesy of Brilliant Earth); charts and graphs courtesy of GemFind Digital Solutions

Follow me on Instagram: @emilivesilind

- Subscribe to the JCK News Daily

- Subscribe to the JCK Special Report

- Follow JCK on Instagram: @jckmagazine

- Follow JCK on X: @jckmagazine

- Follow JCK on Facebook: @jckmagazine