Retail experts and jewelers lay out the best strategies for selling lab-grown and mined diamonds together

As the awareness and availability of lab-created diamonds have increased sharply within the past few years, this alternative to mined diamonds presents both a challenge and a tremendous opportunity for savvy jewelers. But it takes a deft touch to sell these gems alongside traditionally sourced diamonds.

“It’s a relatively new category, but it’s growing really quickly in both bridal and in fashion,” says Marty Hurwitz, cofounder of MVI Marketing, based in Austin, Texas. “Retailers, even those that were early on a little resistant to the newness of it and the nontraditional nature, are very quickly gravitating toward it, and consumers are asking about it organically.”

Diamond industry analyst Edahn Golan says that although the share of lab-grown diamonds sold through independent jewelers in the bridal category is only around 5%, that figure reflects astonishingly fast growth—more than 40% on a year-over-year rate.

“When you look at sales on a store-by-store basis, one of the things we’re seeing is some stores sell a little bit of lab-grown, but some stores are what we call super sellers—more than 50% of their diamond sales are lab-grown,” Golan says.

How to Get Started

Experts say it is possible to do a brisk business in both kinds of diamonds without undercutting prices or cannibalizing sales of either type. Achieving that balance requires knowing how to position lab-grown—not in opposition to mined diamonds, but as a distinct product type in its own right, Golan says.

“There’s a big difference,” Golan says. Customers “don’t view it as an alternative to mined diamonds. They view it as a different category.”

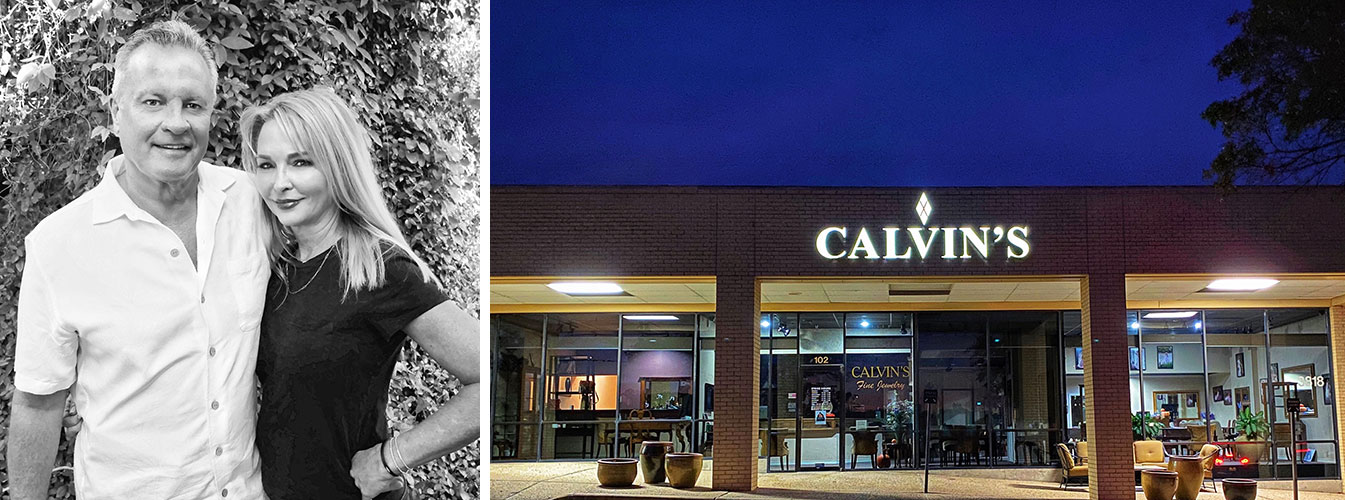

Calvin’s Fine Jewelry has been a fixture in Austin since 1997 but started carrying lab-grown diamonds only about four years ago, says owner Calvin Smith. “It was a real easy decision for the customer, and we were just off to the races,” he says. “My margins are better, and it’s been a game changer just for my store. I sell 75% more lab-grown than mined.”

Some store owners who have found success selling lab-grown diamonds admit the popularity of the category took them by surprise. “We’re a pretty traditional, old-school jewelry store, family owned, and we started using lab-grown diamonds kind of as a fluke,” says Laura Sipe, co-owner of J.C. Sipe Jewelers in Indianapolis. “To our surprise, for first-time engagement rings, they’re far and away outselling mined diamonds.”

How Each Diamond Customer Differs

While jewelry retailers in some parts of the country say many customers who come through their doors already know about lab-grown diamonds and specifically ask for them, success also entails being able to identify customers who are unfamiliar with the product but are open to it once educated.

“We make sure that they understand that we’re going to give them a crash course in diamonds, and we don’t have an opinion on which is quote-unquote better—they’re different for different reasons,” says Charles Kuba, owner of Iowa Diamond in Des Moines, Iowa.

By and large, the people who purchase lab-grown diamonds tend to skew younger, especially when it comes to bridal jewelry, Kuba says. “A lot of them are the kids graduating from college with $100,000 in debt. That’s why they’re living in their parents’ basements. So when somebody comes in with a budget and they see that they can maximize it, I think that’s why they’re going so strongly in the direction of lab-created.”

Young people on a budget are by no means the only customers drawn to lab-grown diamonds. Smith says they are a popular choice for many of his local customers. “Austin is a market where there are a lot of tech folks, and they love things that are different.”

Customers who have a strong or stated preference for mined diamonds, Sipe says, are often older and more affluent. The price point on the mined diamonds she sells has risen since the segment of shoppers with a single-minded focus on mined diamonds often want unique shapes or larger stones, attributes that can command a premium.

How to Talk About Value Without Undercutting Sales

Lab-grown diamonds’ significantly lower price point compared to that of naturally occurring diamonds is a double-edged sword: It can draw in younger customers and give them more carats for their dollars, but jewelers are understandably leery about undercutting the value proposition of traditional diamonds.

“The biggest pressing issue is how do [retailers] sell this without devaluing their mined diamond inventory,” Hurwitz says. “The answer to that is they have to tell the story of both.”

While there certainly are customers whose purchase decisions are influenced by environmental and humanitarian concerns, much of the motivation to choose a lab-grown diamond remains the buyer’s budget, Smith says.

“The American consumer is very price-conscious, but you can’t treat your customer as being very price-conscious,” Golan says. “You can’t make it look as if they’re cheap.”

Because a large portion of the market for lab-grown diamonds is engagement rings, jewelers who sell both types of stones say a winning strategy is to start with a mined diamond, then show shoppers what size and clarity they could have in lab-grown for the same amount of money.

“We don’t use lab-grown to meet price points,” Sipe says. “We try to get the consumer a better, nicer diamond”—and size matters, she adds. “Say you’ve got a $10,000 budget. You can shop for a really nice 1 carat mined diamond, or for that kind of money, you’ll get a 2 carat lab-grown of almost the same quality.”

Letting a customer see the two side by side is what often seals the deal, Smith says. “Once we start showing them larger stones, we’ll start off with a mined diamond,” he says. Then, it’s a matter of asking if they’d like to see something bigger and better—for the same price. Most customers are intrigued. And when they see how much more they can get in terms of size and clarity grade with a lab-grown diamond, he says, “they look stunned.”

Retailers also have strategies for avoiding one common sticking point: resale value. For customers who spend thousands of dollars on an engagement ring with the expectation that the piece will hold its value, jewelers find they have to be clear that the long-term prospects for lab-grown diamonds—where the supply is virtually infinite—are at best unknown.

Jewelers like Smith suggest steering customers away from the idea that the diamond they plan to buy is an investment asset like stocks or real estate. “We’re very up front with them about resale value,” he says.

Smith adds that his store has a policy designed to incentivize customers to trade up. “We will do a 100% trade-in as long as they’re upgrading,” he says.

How to Branch Out Beyond Bridal

Outside of the bridal market, experts say there is enormous potential for lab-grown diamonds in the fashion jewelry segment.

A natural next step after a customer purchases an engagement ring is diamond studs, Sipe says. “A lot of the appeal is how big it looks on your ear, and with lab-grown, instead of 1 carat total weight, you can get 2 carats.”

Sipe says diamond bracelets with lab-grown gems have been popular too. The lower price point of lab-grown diamonds puts these kinds of aspirational purchases within reach of younger customers for whom the mined equivalent would be unaffordable.

There also is a bright future for lab-created diamonds in brand-name fashion jewelry. In May, Pandora debuted a lab-grown diamond collection called Pandora Brilliance and announced it will no longer use mined diamonds, touting the sustainability and value proposition of lab-grown stones. (The collection debuts in the U.K. and will be expanded into “other key markets” next year, the company said.)

Promoting and selling lab-grown diamonds in the context of a strong brand identity will be critical to growing out this segment as it matures, Golan predicts. “I’m convinced that the future of lab-grown is to have branding,” he says. “I think if you want to be able to sell something that’s beautiful and do it successfully over time, you need to develop a brand.”

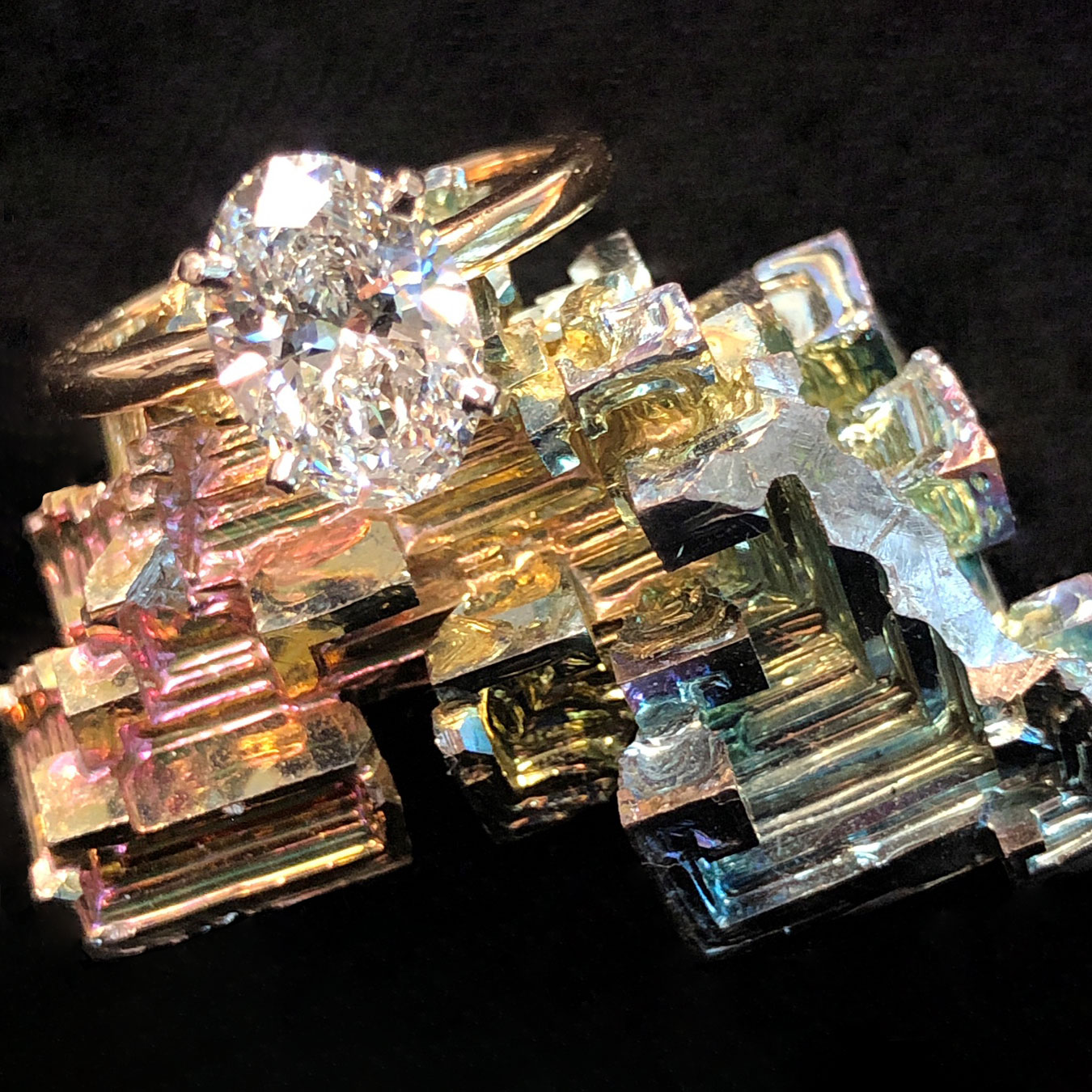

Top: 2.58 ct. round brilliant lab-created diamond in a simple solitaire on an aragonite specimen from the Smithsonian Institution, price on request; Iowa Diamond