Intent on marketing and selling its products directly to consumers, today’s watch industry is nothing like its former 19th-century self

JCK’s earliest forerunner, a magazine called the American Horological Journal, is not what most people would consider an easy read. Founded in July 1869, the monthly publication featured 13 articles in its debut issue, spread across 28 pictureless pages, including a 5,700-word treatise on “Astronomy in Its Relations to Horology” and a news item on “the approaching total eclipse of the sun, on the 7th of August next.”

In its hyper-detailed focus on watch- and clockmaking, the text-only pamphlet was a reflection of its time. The advent of factories, machines, and industrialized production—much of it fueled by the expansion of the railroads—had spurred demand for timekeeping among the masses. As a result, watchmakers began springing up in cities and towns across America.

“There was a huge boom in the industry,” says Jordan P. Ficklin, executive director of the American Watchmakers-Clockmakers Institute in Harrison, Ohio. “They needed a way to share information and communicate with their customers.”

Emphasis was given to articles on how the Yanks’ industrialized pocket watch industry was outperforming Switzerland’s hoary cottage trade.

“Everywhere and among all nationalities, the American watch is known and prized,” said an editorial in the August 1870 edition of The Watchmaker and Jeweler, one of the trade journals later absorbed by what eventually became JCK. “While on the other hand the business, so far as the better class of time-keepers is concerned, has almost ceased in Switzerland, and the watchmakers there are now chiefly engaged in producing hand-made imitations, which they are seeking to impose upon buyers.”

Even when The Jewelers’ Circular, a jewelry trade publication founded in February 1870, acquired the American Horological Journal in 1873, the newly combined magazine religiously tracked news and developments in the American watch market for its target audience: store owners.

“We see early on in the American watchmaking industry a desire to work with retail jewelers,” Ficklin says. “The different companies were producing parts that could be interchanged within one watch and producing watch movements of a standard size. Customers could pick the quality of the movement, the dial they liked, and the case they liked, and the jeweler would put them together right there.”

This represented a sea change for retailers, who now had the ability to service customers quickly and efficiently. “Prior to 1850, when someone brought in a broken watch, the watchmaker or jeweler had to make something from scratch,” Ficklin says. “Now they could order the parts they needed, so it made repair easier as well.”

The American industry happily continued like this well into the 20th century, until soldiers returning from the battlefields of World War I brought back a preference for wristwatches, once considered “effeminate,” says horological historian David Christianson.

“When these hardened soldiers came back, wristwatches became the vogue and pocket watches went out of style,” he says.

Indeed, a 1931 feature about watch straps in The Jewelers’ Circular reminded readers that “a substantial source of profits can be found by the alert jeweler in the forceful merchandising of watch attachments.”

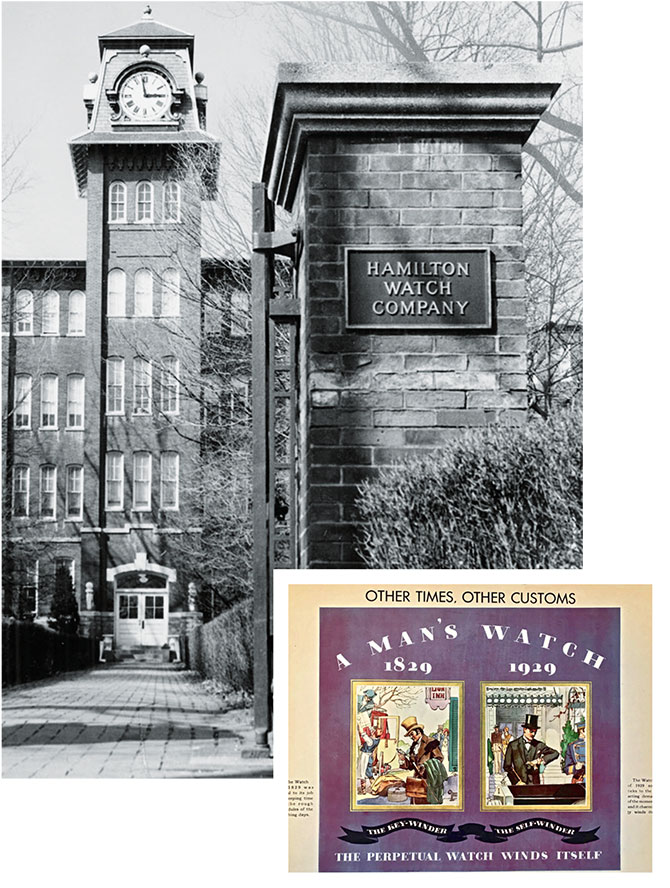

The explosion in demand for wristwatches, however, had an unintended consequence: “The American watch companies—Elgin, Hamilton, Waltham, Illinois—had a terrible time adjusting their production and machinery to making them,” Christianson says.

It was the beginning of the end for the American industry and the start of Switzerland’s ascent, as companies such as Longines and Patek Philippe began to best the Americans in their own backyard.

Even as the two nations jockeyed for market share, with the Swiss emerging as victors in the years following World War II, American retailers remained the prize. “The Swiss companies would flood the jewelers and watchmakers with technical guides on how to properly service their watches,” says Christianson, who witnessed it all firsthand as a watchmaker at his family’s jewelry store in Kendallville, Ind. “If you go to these old watchmakers like me and look in their files, you’ll see file drawers full of technical information about Swiss watches.”

Concurrently, the Swiss partnered with well-regarded American distributors—men like Norman Morris, Herman Plotnik, and Ben Kaiser, who distributed Omega, Vacheron Constantin, and Baume & Mercier, respectively—to ensure their timepieces appeared in retail showcases around the country.

“Ben Kaiser was the nicest man in the world,” recalls former Tourneau executive Andrew Block, who now runs his own New Jersey–based watch consultancy. “His company was called the David G. Steven Agency—that was Baume & Mercier. And that’s how relationships became the backbone of the industry.”

Then came the quartz crisis of the 1970s. The onslaught of cheap Japanese-made battery-powered watches decimated half of Switzerland’s mechanical watch industry. The companies that survived emerged from the crisis in tatters, ripe targets for acquisition by publicly owned groups that saw an opportunity in positioning mechanical timepieces as luxury goods.

In 1988, South African businessman Johann Rupert founded the Geneva-based Richemont group—then known as Vendôme—an early architect of today’s consumer-driven marketplace. Under his stewardship, the company began to acquire some of the greatest brands in Swiss watchmaking—Cartier, Montblanc, Baume & Mercier, and Vacheron Constantin—wresting power from distributors and retailers in the process.

“In the mid-’90s, brands started to expand their product offerings and command more space in retail stores,” Block recalls. “Under threat of losing the brand, you had to give them more space.”

By Block’s reckoning, the Swiss began to grow beyond their niches—men’s brands ventured into the women’s category, for example—demanding more showcase real estate and visibility from their retail partners, not to mention more sales. “If you couldn’t buy all that inventory, what would happen?” he says. “Brands started to get frustrated that you as a retailer weren’t representing the brand as it was properly supposed to be shown.”

The tension between Swiss watchmakers and their American wholesale partners has come to a boiling point in recent years, as brands have tightened their distribution. Some, such as Audemars Piguet and Richard Mille, have abandoned multibrand retail altogether in favor of going direct to consumers—via their own boutiques and e-commerce channels.

In parallel, many Swiss brands have also restricted access to spare parts in an effort to consolidate service under their own roofs.

Rolex was among the holdouts, but according to Christianson, the mega-brand canceled scores of spare parts accounts earlier this year, including his own, meaning he can still repair Rolex watches but must source parts on the open market.

“One of the more difficult parts to find is a pallet fork for any of the Rolexes,” he says. “If you had a parts account, you’d be paying maybe $30 for it. Now if you can find it, you’re going to pay $230 and so will the customer.”

Meanwhile, the smartwatch incursion, led by the category-leading Apple Watch, is threatening watch sales in the less-than-$1,000 segment. For retailers who’ve built their businesses on sales of timepieces, the news isn’t easy to read. But what else is new?

Top: A 60 mm pocket watch—the largest Hamilton typically made—dating to 1906

(Waltham factory: Waltham Public Library; Rolex: courtesy of Christie’s; United States Watch Co. pocket watch: Reprinted with permission from the National Watch & Clock Museum)