Sue Rechner (pictured), who became CEO of WD Lab Grown Diamonds last year, spoke with JCK on Thursday about the pair of announcements her company made this week: It’s hired new executives and entered into patent sublicenses with two lab-grown companies, including one it had previously sued for patent infringement. She also discussed the lab-grown diamond industry in general, where prices are going, and why she feels her company is different from other players in the market.

JCK: You just brought on a chief marketing officer. Do you plan to go direct-to-consumer, like your competitors?

Sue Rechner: We’re not going to move away from our focus on providing support and partnership to our customers. With [chief marketing officer] Brittany [Lewis] coming on board, we have the ability to build our business and our brand with the end consumer in mind, both in providing the right product assortment for our partners and really being consumer centric and creating a brand that educates and informs consumers with the information they need to confidently make their buying decisions.

Consumers are in the driver’s seat right now, and value propositions matter. You have to be responsive to what they want, and your brand has to reflect the world in which we live. We need to create a brand that has a unique and distinct point of difference and embraces values that consumers can relate to. Brittany’s expertise will help us do that.

But if you’re primarily selling wholesale, why would you need a brand?

Everybody has to have a distinct and unique selling proposition, and, for us, being able to associate a brand with a selling proposition in the industry is critical. There’s a lot of bad actors out there, and we want to make sure we can distinguish what WD stands for: grown in the USA, soon-to-be sustainably certified, corporate transparency, complete custody of our supply chain. We have the ability to create product without doing post-growth treatment. We have far more capabilities than others.

You think about Intel inside. Everybody buys a computer, but everybody’s computer has an Intel chip in it because they know that they’re going to get quality. But Intel doesn’t do direct-to-consumer [sales] at all. I’m not suggesting direct-to-consumer will never occur, but right now our focus is on building up our customers.

Do you see a business-to-consumer brand happening in the near term?

It’s not in our short-term plans. Direct-to-consumer has also become very relevant today because people are not always shopping in stores. So there’s something to be said for that. But right now, our focus is going to be building our business with the end consumer, but also supporting our partnership with our business-to-business customers.

You are working to have your diamonds certified as sustainably produced by SCS Global Systems. [Note: This standard can be seen here and is now open to both natural and lab-grown diamonds.]

This sustainability certification is near and dear to my heart. It’s one of the reasons I stepped into this role, because I thought it could be a game changer for the overall diamond category. WD is on track to be the first company certified through SCS, which is a milestone, not just for our brand but also the entire industry, because that is what consumers expect. They vote with their wallet, and people want to know what they’re buying, where it comes from, and they understand the impact that it has on the world. So this is a major accomplishment for us.

Your previous CEO admitted that growing diamonds takes a large amount of energy. How has that affected your ability to be certified as sustainable?

We were evaluated under 15 core environmental impact categories that SCS has as a baseline. We’re working toward zero impact for all environmental and human health impact. We’re working toward achieving full climate neutrality. Do we use a lot of electricity? Yes. But, there are ways to improve. Once you judge yourself and once you give yourself a report card, you then have the ability to start doing things to improve the impacts that you’re having on the world. So the first thing is to give yourself a baseline, and that was done by SCS. They have exhaustively audited our facility, our supply chain, and our chain of custody. We are going to use the most advanced empirical testing technology available to provide provenance signature and gem identification matching, so we will establish 99% accuracy for the provenance of our diamond.

It’s not been easy. We have been working on this since, I believe, January. We’ve opened our books and opened our kimono to say, these are all the things that we’re doing, tell us how we can get better. That’s where it all starts and that’s what consumers want to hear. They want to hear that companies are being transparent about who they are, how they operate, and the impact they have on the world.

WD has taken perhaps a less hostile view of the natural diamond industry than some of your competitors. Do you see that continuing?

Our focus is on our own business. We’re not interested in getting into word wars with other categories. The category has enough room for everybody. We really should work together to educate consumers on the total category. It’s not going to help anybody to put others down, and it’s not going to elevate the category.

You recently signed sublicense agreements with two lab-grown companies. How does that affect your ongoing patent litigation with three other lab-grown companies?

I can’t speak to ongoing litigation. I can tell you that we’re very excited that both ALTR and Evolution have validated our view on the patents. They have obviously signed license agreements because they believe the patents are valid. Additionally, we are really excited to work arm-in-arm with them and really move things forward and expand the access of legitimate CVD [diamonds grown with chemical vapor deposition]. The more people we bring under the tent, the better off it is, because the category overall will benefit.

Obviously, the category is getting a lot more crowded. We’re seeing a lot of lower-cost lab-grown diamonds, particularly produced by China. A lot of industries have been undercut by Chinese competition. Is that a concern for you?

There’s always going to be low-priced players. You’re not going to stop them. One reason why we want to create a unique position in the category is because we want to make sure that the consumer is able to distinguish between the quality players and everybody else. I think the more we can educate, the more we can build our unique point of difference, the more we can provide transparency and chain of custody, the more the category will grow, and the less people will rely on the low-priced sellers. It’s a long-term play. It’s definitely a marathon, not a sprint, to separate the category from just being a low-priced race to the bottom.

While demand has been rising, reports say prices are falling. Where do you see prices going in the near term?

We’ve seen actually the opposite. Prices have definitely stabilized or have actually gone up in the last couple of weeks in the larger sizes. There were people who, in the short term, were trying to raise cash, people that were having liquidity issues, probably sold goods at less than top price. But I see prices stabilizing and likely going up over the course of the next six to 12 months.

You mentioned not treating your goods. Do you see selling “as grown” goods as a point of differentiation?

It’s a differentiator. There’s no question. Our process—both our patents and the proprietary process we put on top of that—put us in a very unique position of not having to treat larger goods to enhance the color. There’s no question it’s a differentiator that we have this elegant process that creates a more pure product that doesn’t require enhancement.

Do you have production numbers?

We don’t share that. We do focus on larger goods, as part of our focus on the bridal category, and better-quality goods. We are working on a daily basis to improve our process discipline, and one of the more interesting things about WD from a production standpoint is we can do what we call bespoke growing. We have the ability to create incredible accuracy in color distribution in our chambers, so we can target our production to customer requirements.

Huron Capital bought your company in 2018. Do you ever see having an IPO?

There’s a multitude of exit possibilities for this business. An IPO is one, but that is usually an in-the-moment decision for what we call an exit, meaning you get to the point where you believe that you as the owners and management team have contributed what you can to get the business to where it needs to be, and you believe that somebody else would be a better steward. I wouldn’t say that will happen in the very near term, but at some point, obviously, there will be something that occurs.

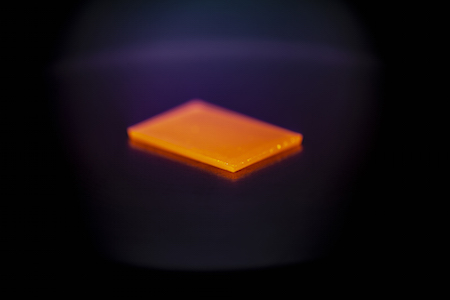

(Image courtesy of WD Lab Grown Diamonds)

- Subscribe to the JCK News Daily

- Subscribe to the JCK Special Report

- Follow JCK on Instagram: @jckmagazine

- Follow JCK on X: @jckmagazine

- Follow JCK on Facebook: @jckmagazine