LVMH’s expensive breakfast is now causing it heartburn.

Last week, the luxury giant wrote that its most recent board meeting “notably focused its attention on the development of the pandemic and its potential impact on the results and perspectives of Tiffany & Co. with respect to the agreement that links the two groups.”

It added that, contrary to “market rumors…it is not considering buying Tiffany shares on the market.”

In November, LVMH agreed to pay $16.2 billion for the famed retailer, or $135 a share, in the largest deal ever in the luxury sector. The deal was due to close in the middle of this year.

However, last week, WWD reported that LVMH’s board was beginning to have second thoughts about the deal “amid a deteriorating situation in the U.S. market.

“[B]oard members of the luxury giant are concerned about the impact of not only the coronavirus pandemic, which has claimed more than 100,000 lives in America and wreaked widespread economic damage, but also the growing social unrest over the death of George Floyd at the hands of Minneapolis police,” the newspaper reported.

On Friday, Reuters, which previously reported that chairman Bernard Arnault was looking to renegotiate the deal, quoted sources saying that “LVMH has decided it will not raise the issue of repricing the deal with Tiffany for now, after it considered the legal hurdles involved.”

It added that Arnault “harbor[s] concerns” that the company overpaid for Tiffany and is continuing to watch Tiffany’s financial conditions deteriorate.

“While Tiffany is in compliance with covenants it had agreed to with its creditors, LVMH will be closely monitoring Tiffany’s finances in the coming weeks to see if this remains the case,” the news service said. “Were Tiffany to be in breach of the covenants, LVMH could use this as grounds under the merger agreement to call for a renegotiation of the terms.”

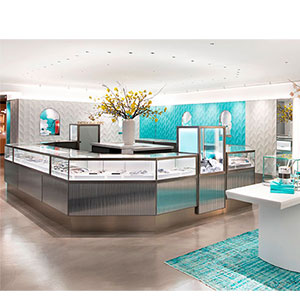

(Image courtesy of Tiffany & Co.)

- Subscribe to the JCK News Daily

- Subscribe to the JCK Special Report

- Follow JCK on Instagram: @jckmagazine

- Follow JCK on X: @jckmagazine

- Follow JCK on Facebook: @jckmagazine