GemFind Digital Solutions, a digital marketing firm focused on gems and jewelry, has released its 2019 Jewelry Consumer Trends Report. Its findings tell the story of what modern consumers are searching for online when researching an engagement ring or loose diamond purchase.

Here’s what the 2019 study found.

Diamond Color Searches

The G color maintains a slight lead in diamond clicks compared to the other grades, followed by Fs, then H, and D (all searches are within 3% of each other and make up for a majority of diamond color click searches). “It’s remarkable that many consumers search for diamonds in the D–F color range, because to the naked eye the perceived increase in color would not be noticeable, but the price increase is dramatic,” reads the report. “However, 30% of searches are for G–H color diamonds, which make up the most popular colors at the retail counter. At the virtual or in-store sales counter, a challenge for retailers is to educate consumers on diamond beauty versus rarity, especially in diamond color. Consumers will strive for the highest possible colors without really knowing the implications of the beauty versus rarity factor in higher diamond colors.”

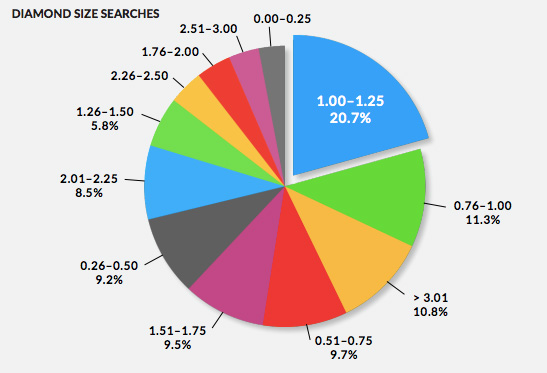

Diamond Size Searches

When searching by diamond size, 1 ct.–1.25 cts. represent one-fifth of all searches (and is one of the most popular sizes for engagement rings). After that, 0.75 ct.–1 ct. comprise more than 10% of the searches, followed by a fairly equal distribution of approximately 10% for 0.25–0.5 ct., 0.5 ct.–0.75 ct., and 1.5 cts.–1.75 cts., and above. “While some claim size matters, that’s not particularly the case in online diamond click searches for diamond size,” reads the report. “More than half of diamond size searches are below 1.25 ct. This represents the full range of engagement ring diamond searches. Diamond click searches for above 1.25 ct. represent 40% of diamond searches. However, in real-time purchases the larger diamond click searches appear to be more aspirational than actual real-time purchases of diamonds.”

Diamond Cut Searches

More than 60%–70% of searches in the diamond cut area are for an excellent cut grade. Searches for ideal- and VG-cut diamonds are less than one-third of the searches for excellent cut. “These results may reflect ongoing diamond education but not the reality,” reads the report. “Diamond appearance and beauty are impacted by many factors. For those in the industry, most understand that the difference between a VG and EX cut in diamond appearance is, at most times, minimal. Yet, from the consumer perspective the excellent cut grade far outweighs consideration of even the Ideal Cut…. Consumer education for diamond purchases appears to prioritize the importance of an excellent cut grade. Therefore, it is more challenging for retailers selling single stone diamonds to educate the customer about overall diamond beauty versus focusing on an excellent cut grade.”

Diamond Clarity Searches

Almost 40% of all diamond searches are for VS 1 and VS 2. “For the consumer who understands the definition of SI 1 as slightly included, the obvious preference is for a VS stone,” reads the report. “However, 30% of all searches are for SI 1 and SI 2. For all consumers, an eye-clean diamond is extremely important, and the majority of purchases based on diamond clicks will be SI and above.”

Jewelry Metal Searches

In terms of gold: 14k white gold comprises more than 40% of jewelry searches by metal; 14k yellow gold currently makes up 15% of the jewelry metal searches; followed by 18k white gold, “which maintains over 11% of the jewelry search market and would appear directly associated with consumers looking for 18k white gold semi-mount wedding rings.” Platinum searches remain stable from last year at 10%.

Jewelry Category Searches

More than half of all jewelry searches revolve around bridal, and semi-mount engagement rings continue to make up almost 30% of jewelry searches. Twenty-eight percent of searches are in the categories of necklaces, earrings, and watches. “This is encouraging for all retailers to know that the bridal /engagement market remains strong,” reads the report. “The challenge at the retail level is the focus on multi-piece purchases that will include items that are upsell purchases after completing the bridal transaction.”

Top: Lark & Berry engagement ring (photo courtesy of Lark & Berry)

Follow me on Instagram: @emilivesilind

- Subscribe to the JCK News Daily

- Subscribe to the JCK Special Report

- Follow JCK on Instagram: @jckmagazine

- Follow JCK on X: @jckmagazine

- Follow JCK on Facebook: @jckmagazine